Open A Bank Account

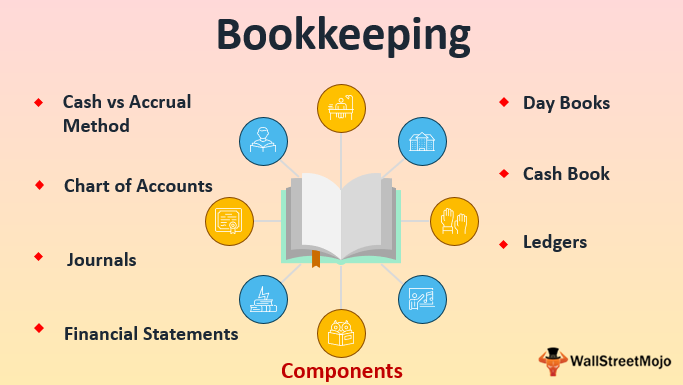

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. The amounts in each of the accounts will be reported on the company’s financial statements in detail or in summary form. Bookkeeping (and accounting) involves the recording of a company’s financial transactions. The transactions will have to be identified, approved, sorted and stored in a manner so they can be retrieved and presented in the company’s financial statements and other reports. The electronic speed of computers and accounting software gives the appearance that many of the bookkeeping and accounting tasks have been eliminated or are occurring simultaneously.

Develop A Bookkeeping System

What are basic bookkeeping skills?

For an entry-level bookkeeping position, some employers only require you to have a high school diploma, but most employers also expect some type of work experience. Learning how to use accounting software, taking some online bookkeeping courses, and even getting certified as a bookkeeper can help your career.

To determine whether errors had occurred, the bookkeeper prepared a trial balance. A trial balance is an internal report that lists 1) each account name, and 2) each account’s balance in the appropriate debit column or credit column. If the total of the debit column did not equal the total of the credit column, there was at least one error occurring somewhere between the journal entry and the trial balance. Finding the one or more errors often meant spending hours retracing the entries and postings. Others see bookkeeping as limited to recording transactions in journals or daybooks and then posting the amounts into accounts in ledgers.

Determine Your Tax Obligations

But they can be an easy and affordable way to make your resume more competitive and help it stand out to employers. The designation of Certified Public Bookkeeper (or CPB) is nationally accredited by the National Association of Certified Public Bookkeepers. But that doesn’t mean you shouldn’t know the financial cost of becoming a certified bookkeeper.

What Is The Easiest Accounting Software For Small Business?

The controller is responsible for financial and managerial accounting; in other words, responding to the firm’s accounting data in an appropriate and responsible manner. Where the bookkeeper records and classifies the financial transactions of the company, the accountant takes the next steps and analyzes, reviews, reports, and interprets financial information for the company. If you are a small business owner, you either have to set up your own accounting system or you have to hire someone to set it up for you. If you are self-employed and it is a one-person business, you will do it yourself.

How Much Is An Accountant For Small Business?

You can then use that picture to make decisions about your business’s future. You’ve created your set of financial accounts and picked a bookkeeping system—now it’s time to record what’s actually happening with your money. Alternatively, you can pay an accountant, bookkeeper, or outsourced accounting company to manage your accounts and ledger for you.

And you definitely don’t need to be a Certified Public Accountant (CPA) or have an accounting degree to start a profitable virtual bookkeeping business. The average salary for a general bookkeeper is around $35,000 with top earners bringing in more than $54,000 per year.

As with all financial occupations, experience and reputation go a long way toward earning a higher salary. Bookkeepers who take the time to truly learn all they can about their profession will have no trouble earning top salaries. While there is no set time frame to becoming a bookkeeper, there is a standard amount of time needed to become a certified bookkeeper. There are two certifications available for bookkeepers, but at least 2 years of full-time experience working as a bookkeeper is required before a candidate is allowed to take either certification exam.

Equity is the ownership a business owner, and any investors have in the firm. If you are going to offer your customers credit or if you are going to request credit from your suppliers, then you have to use an accrual accounting system. Using accrual accounting, you record purchases or sales adjusting entries immediately, even if the cash doesn’t change hands until a later time, such as in the case of Accounts Payable or Accounts Receivable. The controller is actually a company’s chief accounting officer. He/she is responsible for setting up and maintaining the company’s accounting system.

- While not all positions require a degree, aspiring bookkeepers benefit from an online associate or bachelor’s degree in bookkeeping, accounting, or a related field.

- What is the difference between accounting and bookkeeping?

- While related, bookkeepers handle day-to-day data entry and record keeping, while accountants use those records to manage tax filings and higher-level financial operations.

For example, imagine that you’ve just purchased a new point-of-sale system for your retail business. However, most bookkeeping is done using the double-entry accounting system, which is sort of like Newton’s Third Law of Motion, but for finances. It isn’t physics, but for managing a business, it’s just as important.

In the world of bookkeeping, an account doesn’t refer to an individual bank account. Instead, an account is a record of all financial transactions of a certain type, like sales or payroll. Stress is part of the workplace, especially in high-pressure jobs like bookkeeping. But it can be effectively managed, and your bookkeeper can continue to perform their role of keeping your company’s financial matters in good order.

If you’re hiring in-house, the US Bureau of Labor Statistics estimates accountants make an average annual salary of $70,000. Bookkeepers come in at $17.26 per hour, according to PayScale. Before you set up your What is bookkeeping system, you have to understand the firm’s basic accounts – assets, liabilities, and equity. Assets are those things the company owns such as its inventory and accounts receivables. Liabilities are those things the company owes such as what they owe to their suppliers (accounts payable), bank and business loans, mortgages, and any other debt on the books.

Bookkeepers tend to be perfectionists who are aware of how essential their job is to the financial health bookkeeping of your company. They collect data from every department in the company, organize, and record it.

After each year’s financial statements were completed, closing entries were needed. The purpose of closing entries is to get the balances in all of the income statement accounts (revenues, expenses) to be zero before the start of the new accounting year. The net amount of the income statement account balances would ultimately be transferred to the proprietor’s capital account or to the stockholders’ retained earnings account. The past distinctions between bookkeeping and accounting have become blurred with the use of computers and accounting software.

What is bookkeeping example?

Accountants are a level up from bookkeepers. They can (but usually don’t) perform bookkeeping functions, but usually, they prepare detailed financial statements, perform audits of the books of public companies, and they may prepare reports for tax purposes.

The difference is that this accounting software is packed with more features than QuickBooks. Become a certified QuickBooks user – Intuit has a training program, which is aimed specifically at business owners who wish to manage their accounting. It is an online course (or CD) on every aspect of using QuickBooks.

Complete a petty cash reconciliation form, in which the petty cash custodian lists the remaining cash on hand, vouchers issued, and any overage or underage. The voucher information may bookkeeping come from the petty cash book. An accounting staff person reviews and approves the form and sends a copy to the accounts payable staff, along with all vouchers referenced on the form.

Babylonian records written with styli on small slabs of clay have been found dating to 2600 BCE. The term “waste book” was used in colonial America, referring to the documenting of daily transactions of receipts and expenditures. Records were made in chronological order, and for temporary use only. Daily records were then transferred to a daybook or account ledger to balance the accounts and to create a permanent journal; then the waste book could be discarded, hence the name.

Many two-year and four-year colleges offer undergraduate certificates in http://polletix.com/the-easiest-and-hardest-college-degree-majors/, which typically take one year to complete and give students the foundational skills necessary to work as a bookkeeper. Earning an undergraduate certificate in accounting also meets the qualifications for many bookkeeping positions.